Quarter Marked by Execution of DoW-Funded Antimony Initiatives to Secure U.S. Domestic Antimony Supply Chain

Melbourne, Australia, Jan. 27, 2026 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” and the “Company”) (NASDAQ: NVA) (ASX: NVA), (FRA: QM3), a gold and critical minerals exploration and development stage company focused on advancing the Estelle Gold and Critical Minerals Project in Alaska, U.S.A. provides its quarterly activities and cashflow report for the quarter ended December 31, 2025

Highlights

- US$43.4 million (A$65.5 million) non-dilutive funding awarded by the U.S. Department of War (DoW), fully funding the establishment of a domestic antimony supply chain at the Estelle Project and materially strengthening the Company’s balance sheet.

- Significant progress toward becoming a fully integrated U.S. antimony producer, including:

-

- Commencement of procurement of critical mining and processing equipment for starter antimony mine operations and the Port Mackenzie refinery.

-

- Securing industrial-zoned land and advancing permitting for a proposed antimony refinery at the deep-water Port Mackenzie site.

-

- Equipment shipments underway, with delivery expected in early 2026 and first production targeted for late 2026/27.

- Gold asset advancement continued across the Estelle Project, one of the largest undeveloped gold systems globally, comprising of over 20 prospects and four defined multi-million-ounce deposits.

- 2025 gold drilling program at RPM North and RPM Valley completed, with results announced post-period in January 2026:

-

- Results expected to support an increase in Measured and Indicated Mineral Resources.

-

- Mineralisation confirmed to remain open at depth and below current pit shells.

- Pre-Feasibility Study (PFS) work ongoing, including metallurgical test work, mine planning and optimisation studies to support development pathways for Estelle’s gold assets.

- Strong corporate and funding position, with access to over A$106 million in funding at quarter end, including cash, DoW funding, liquid investments and in-the-money warrants, and no debt.

On the quarter, Nova CEO, Mr Christopher Gerteisen, commented:

“The December quarter was marked by the award of US$43.4 million in non-dilutive funding from the U.S. Department of War, which fully funds the development of stage 1 antimony production at Estelle, which will feed into the U.S. supply chain. This support enables us to accelerate our strategy to become a fully integrated U.S. producer of military-grade antimony.

“Fuelled by this funding, the Company progressed the procurement of antimony key mining and processing equipment - with delivery expected in early 2026 - and continued planning and permitting for infrastructure planning at the proposed Port Mackenzie refinery site. With industrial-zoned land secured, strong federal, state and local government support, and established infrastructure in place, Nova is well-positioned to advance toward first antimony production targeted for late 2026 to early 2027.

“In parallel, our team continued to progress development activities across the Estelle gold assets. The 2025 drilling and surface sampling programs were completed during the quarter, and these results are expected to support an updated Mineral Resource Estimate and ongoing pre-feasibility work, which we expect will further demonstrate the scale and quality of Nova’s gold and antimony assets in a tier-one jurisdiction.”

Gold Assets

Nova is rapidly advancing one of the largest undeveloped gold deposits in the world, consisting of over 20 prospects, including four already defined multi-million-ounce gold deposits.

2025 Drill Program

Post-period, in January 2026, the Company announced the results of its 2025 drilling program at RPM North and RPM Valley. The 2025 drill program was centred on the RPM North area and focused on testing extensions to the east and west with the objective of linking to the RPM Valley zone. A second rig operated at RPM Valley was also dedicated to resource expansion and definition drilling.

Both sets of results are expected to contribute to Measured and Indicated Mineral Resources at the deposits, in support of the PFS.

At RPM North, broad near-surface gold intersections continued, with drilling extending the halo around the high-grade core zone and a new eastern discovery. The strong results followed previous drilling, and support continuity of mineralization to the east, highlighting potential resource upside where earlier drilling intersected 259m @ 0.5 g/t Au from surface.

Closely spaced infill results at RPM Valley returned multiple broad intercepts >1 g/t Au, with visible gold observed, and a project record intercept of 0.5 m @ 364 g/t Au. The results confirmed continuity of mineralization at RPM Valley, with the system remaining open at depth and below current pit shells.

Additional drill results will be released once received and reviewed under Nova’s QA/QC procedures, after which an updated Mineral Resource Estimate (MRE) will incorporate results from the 2023-2025 drill programs.

Surface Sampling Program

Results from the extensive soil and rock chip surface samples taken from across the project area in 2025 will be reported once received and processed.

Feasibility Studies

PFS-level studies are ongoing, with METS Engineering undertaking additional metallurgical test work to build on the high gold recoveries achieved at RPM to date (ASX Announcement: 5 August 2025), Rough Stock Mining is conducting mining studies, and Whittle Consulting is completing optimization studies.

Antimony Assets

Following the award of US$43.4 million from the U.S. Department of War (DoW), Nova initiated its plan to develop antimony production in Alaska. The company is fully funded to establish a U.S. domestic antimony supply chain that would support U.S. military and consumer markets from late 2026 to early 2027. With seven antimony prospects identified across the Estelle Project to date, permitted industrial land, government support, and plans for critical infrastructure in place, Nova is positioned to become a key supplier to the U.S. antimony market.

2025 Drill Program

Drilling briefly resumed at Stibium in October; however, deteriorating weather conditions required the rig to be shut down for the winter. The rig has been winterised on the pad, and drilling is scheduled to recommence in the Alaskan spring of 2026.

Infrastructure Development

In October 2025, Nova secured a land use permit for an antimony refinery at Port MacKenzie, supporting the development of a U.S. critical minerals hub and enabling the establishment of downstream antimony processing and refining operations in Alaska’s Matanuska-Susitna Borough, a region with established infrastructure and capacity for rapid development.

The permit covers 42.81 acres of commercial-industrial zoned land near the critical Port MacKenzie infrastructure for a proposed antimony refinery, The proposed refinery site at Port MacKenzie is strategically aligned with the fast-progressing West Susitna Access Road and other regional development projects currently underway.

Figure 1. Photo of the proposed Port MacKenzie refinery site land area, where Nova has obtained land use rights\

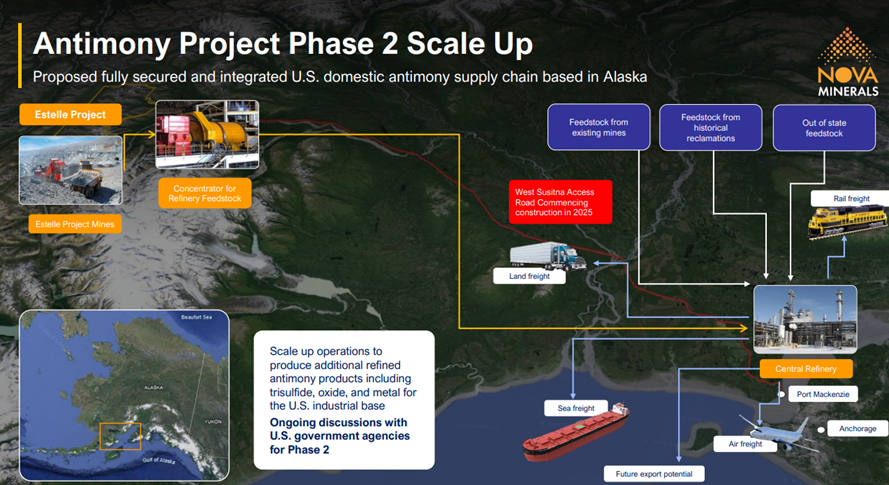

Figure 2. Nova’s proposed fully secured and integrated U.S. domestic antimony supply chain plan

Equipment Procurement

During the quarter, Nova commenced the procurement of critical mining and processing equipment for its Estelle starter antimony mining operations and associated downstream antimony refinery at the deepwater Port Mackenzie, Alaska.

Key equipment purchases included a mining fleet for onsite operations, a crusher and screening plant, and ore sorters to be installed at both the Whiskey Bravo camp and Port Mackenzie refinery sites. As at the end of the quarter, this equipment was being shipped to the staging site and is expected to be received and mobilised to camp on the winter road during Q3 2026.

Additional processing infrastructure, including a mill, and flotation and gravity circuits, was also being procured for transport to the site via the snow road in early 2026.

Onsite ore sorters and concentration circuits will be utilized to process the stibnite stockpiles already collected at site for near term antimony production.

Figure 3. CAT front end loader purchased as part of the mining fleet for onsite operations

Figure 4. CAT excavator purchased as part of the mining fleet for onsite operations

Corporate

- As of the close of the December 2025 quarter, the Company has access to over A$106 million in funding comprising of, A$59.2 million in cash, US$30.4 million (A$45.3 million) remainder of the 24 month award from the U.S. Department of War to support antimony production in Alaska, and approximately ~A$1.5 million in liquid investments and in the money warrants, with no debt.

- At the beginning of the quarter, Nova’s 100% owned U.S. subsidiary, Alaska Range Resources, LLC (ARR), was awarded US$43.4 million (A$65.5 million) in Defense Production Act Title III funding by the U.S. DoW to produce antimony trisulfide at the Estelle Project in Alaska. This award will enable Nova, through ARR, to accelerate development of a fully integrated U.S. antimony supply chain to extract, concentrate, and refine stibnite to produce military-grade antimony trisulfide to assist in meeting the U.S. defense industrial base demands.

- Following the announcement of funding by the U.S. DoW, the Company was invited by His Excellency The Hon Dr Kevin Rudd AC, Australian Ambassador to the United States, to provide a briefing on its Estelle Project. The briefing took place ahead of a meeting between the Australian Prime Minister, Anthony Albanese, and U.S. President Donald Trump in Washington, DC. This request highlighted the growing strategic importance of the Estelle Project and the vital role it will play in securing the U.S. domestic supply of antimony.

- In October 2025, Nova completed a 5-for-1 forward split of its Nasdaq-listed American Depository Shares (ADS), aimed at enhancing trading liquidity and alignment with peer trading prices in the U.S. market.

- In December 2025, the Company also completed an underwritten Nasdaq capital raise, pricing ~2.93 million ADS’s at ~US$6.83 per ADS, raising approximate gross proceeds of US$20 million (before expenses) to support exploration, feasibility work, permitting and working capital requirements.

- Notable investing and operating cash flow items during the quarter included: $7.4M exploration and evaluation costs, principally related to drilling, the PFS test work, mining and environmental studies, sample analysis, permitting, and camp running costs, $2.2M property, plant and equipment relating to mining and processing equipment purchased using DoW funds for the antimony project, $1.2M administration and corporate expenses, the majority of which are related to marketing and share registry costs, and $1.2M for professional fees related mainly to investor relations and consulting and advice in respect of the antimony project.

- Payments to related parties in Q2 FY26 were $344k and included CEO and Executive remuneration and non-executive director fees.

Next Steps

- Stibium drill results

- Further results and potential discoveries from the 2025 surface exploration mapping and sampling program

- Material PFS test-work results as they become available

- Updated MRE

- Winter trail mobilization of heavy equipment

- Airborne geophysical surveys to commence in the spring of 2026

- Antimony phase 1 project updates

- Metallurgical test work ongoing

- Environmental test work ongoing

- West Susitna access road updates

New videos released during the December 2025 quarter

- Nova Minerals CEO, Christopher Gerteisen talks at the Emerging Growth Conference in October 2025

- Massive US grant to Nova Minerals fuels Alaska’s resource revival | Fox Business Video

Major ASX Announcements during the December 2025 quarter

| DoW Awards US$43.4M to Nova for Antimony Production |

| Land Use Secured for Antimony Refinery at Port MacKenzie |

| Nova Engaged for Aus. Govt Meetings with US President Trump |

| Nova Undertakes Share Split of NASDAQ Listed ADSs |

| Nova commences procurement of mining & processing equipment |

| 2025 AGM - Letter from Nova Chairman, Mr. Richard Beazley |

| Nova Announces Closing of US$20m NASDAQ Offering |

| Investor Presentation – December 2025 |

Top 20 Shareholders

To access an up-to-date list of the Company’s top 20 shareholders, please visit the investor centre on Nova’s website or click the link here.

Estelle Gold Project Discussion and Analysis

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations and videos, all available on the Company’s website.

www.novaminerals.com.au

This announcement has been authorized for release by the Executive Directors.

| Christopher Gerteisen CEO and Executive Director E: info@novaminerals.com.au | Annalise Batchelor Sodali & Co Investor Relations & Media E: annalise.batchelor@sodali.com M: +61 432 312 807 | Cameron Gilenko Sodali & Co Investor Relations & Media E: cameron.gilenko@sodali.com M: +61 466 984 953 |

About Nova Minerals Limited

Nova Minerals Limited is advancing one of the world’s largest undeveloped gold deposits into production and securing a US domestic supply of the critical mineral antimony. The company is focused on the exploration and development of the Estelle Gold and Critical Minerals Project, located in Alaska, a tier-one mining jurisdiction.

Estelle hosts two defined multi-million-ounce gold resources, and more than 20 prospects distributed along a 35-kilometre mineralised trend, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world's largest gold mines and discoveries including, Kinross Gold Corporation's Fort Knox Gold Mine. In parallel, Nova is advancing its critical minerals strategy, fully-funded by a US$43.4 million U.S. Department of War award to develop a domestic antimony supply chain, targeted for production in late 2026/2027.

Competent Person Statements

Mr Vannu Khounphakdee P.Geo., who is an independent consulting geologist of a number of mineral exploration and development companies, reviewed and approves the technical information in this release and is a member of the Australian Institute of Geoscientists (AIG), which is ROPO accepted for the purpose of reporting in accordance with ASX listing rules. Mr Vannu Khounphakdee has sufficient experience relevant to the gold deposits under evaluation to qualify as a Competent Person as defined in the 2012 edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Vannu Khounphakdee is also a Qualified Person as defined by S-K 1300 rules for mineral deposit disclosure. Mr Vannu Khounphakdee consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The information in the announcement dated today that relates to exploration results and exploration targets is based on information compiled by Mr. Hans Hoffman. Mr. Hoffman, Owner of First Tracks Exploration, LLC, who is providing geologic consulting services to Nova Minerals, compiled the technical information in this release and is a member of the American Institute of Professional Geologists (AIPG), which is ROPO, accepted for the purpose of reporting in accordance with ASX listing rules. Mr. Hoffman has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the ‘Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Hoffman consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The Exploration results were reported in accordance with Clause 18 of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (2012 Edition) (JORC Code).

The Company is also listed on the NASDAQ in the United States and, as a result, is required in respect of its exploration and resource reporting to comply with the US Securities and Exchange Commission (SEC) requirements in respect of resource reporting in the USA. This requires compliance with the SEC’s S-K 1300 resource regulations. Investors accessing the Company’s NASDAQ press releases should be aware that S-K 1300 statements made in those releases are not JORC Code compliant statements.

Nova Minerals confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcements, and in the case of the exploration results, that all material assumptions and technical parameters underpinning the results in the relevant market announcement continue to apply and have not materially changed.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget” “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or indicates that certain actions, events or results “may”, “could”, “would”, “might” or “will be” taken, “occur” or “be achieved.” Forward-looking information is based on certain factors and assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, Gold and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labor costs, the estimation of mineral reserves and resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, permitting and such other assumptions and factors as set out herein. apparent inconsistencies in the figures shown in the MRE are due to rounding Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in Gold prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labor costs; general global markets and economic conditions; risks associated with exploration of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at the Project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of the Company; the risk of litigation.

Although the Company has attempted to identify important factors that cause results not to be as anticipated, estimated or intended, there can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Forward looking information is made as of the date of this announcement and the Company does not undertake to update or revise any forward-looking information which is included herein, except in accordance with applicable securities laws. All drilling and exploration activities is subject to no unforeseen circumstances.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity | ||

| Nova Minerals Limited (ASX: NVA) | ||

| ABN | Quarter ended (“current quarter”) | |

| 84 006 690 348 | 31 December 2025 | |

| Consolidated statement of cash flows | Current quarter $A’000 | Year to date (6 months) $A’000 | ||

| 1. | Cash flows from operating activities | |||

| 1.1 | Receipts from customers | |||

| 1.2 | Payments for | (83) | (305) | |

| ||||

| ||||

| ||||

| (391) | (708) | ||

| (1,187) (149) | (1,804) (640) | ||

| (1,181) | (1,256) | ||

| 1.3 | Dividends received (see note 3) | |||

| 1.4 | Interest received | 170 | 316 | |

| 1.5 | Interest and other costs of finance paid | (9) | (10) | |

| 1.6 | Income taxes paid | |||

| 1.7 | Government grants and tax incentives | |||

| 1.8 | Other (provide details if material)

| 123 | 123 | |

| 1.9 | Net cash from / (used in) operating activities | (2,707) | (4,284) | |

| 2. | Cash flows from investing activities | |||

| 2.1 | Payments to acquire or for: | |||

| ||||

| ||||

| (2,192) | (2,225) | ||

| (7,337) | (13,255) | ||

| - | (1,000) | ||

| ||||

| 2.2 | Proceeds from the disposal of: | |||

| ||||

| ||||

| ||||

| 230 | 230 | ||

| ||||

| 2.3 | Cash flows from loans to other entities | |||

| 2.4 | Dividends received (see note 3) | |||

| 2.5 | Department of War Grant | 19,576 | 19,576 | |

| 2.6 | Net cash from / (used in) investing activities | 10,277 | 3,326 | |

| 73. | Cash flows from financing activities | 33,598 | 52,164 | |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | |||

| 3.2 | Proceeds from issue of convertible debt securities | |||

| 3.3 | Proceeds from exercise of options and warrants | 3,503 | 3,621 | |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | (2,256) | (3,716) | |

| 3.5 | Proceeds from borrowings | |||

| 3.6 | Repayment of borrowings | |||

| 3.7 | Transaction costs related to loans and borrowings | |||

| 3.8 | Dividends paid | |||

| 3.9 | Finance Lease | (42) | (42) | |

| 3.10 | Net cash from / (used in) financing activities | 34,803 | 52,027 | |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | |||

| 4.1 | Cash and cash equivalents at beginning of period | 17,529 | 9,086 | |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (2,707) | (4,284) | |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | 10,277 | 3,326 | |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 34,803 | 52,027 | |

| 4.5 | Effect of movement in exchange rates on cash held | (726) | (979) | |

| 4.6 | Cash and cash equivalents at end of period | 59,176 | 59,176 | |

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter $A’000 | Previous quarter $A’000 |

| 5.1 | Bank balances | 59,176 | 17,529 |

| 5.2 | Call deposits | ||

| 5.3 | Bank overdrafts | ||

| 5.4 | Other (provide details) | ||

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 59,176 | 17,529 |

| 6. | Payments to related parties of the entity and their associates | Current quarter $A'000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 344 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity.Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end $A’000 | Amount drawn at quarter end $A’000 |

| 7.1 | Convertible facilities(1) | ||

| 7.2 | Credit standby arrangements | ||

| 7.3 | Other (please specify) | ||

| 7.4 | Total financing facilities | ||

| 7.5 | Unused financing facilities available at quarter end | ||

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| 8. | Estimated cash available for future operating activities | $A’000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (2,707) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (8,337) |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (10,044) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 59,176 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 59,176 |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 5.89 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

| 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

| Answer: N/A | ||

| 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

| Answer: N/A | ||

| 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

| Answer: N/A | ||

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 27 January 2026

Authorised by: Board of Directors

(Name of body or officer authorising release – see note 4)

Notes

- This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

- If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

- Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

- If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

- If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.